**This is part of our series highlighting startups who share our mission of trying to make people’s lives just a little easier**

Twenty years ago, the idea of walking into a store, tapping a piece of plastic onto a small device, and going on your merry way would have been a crazy one.

But it’s happened.

The need for speed and efficiency when it comes to things like payments has pushed the industry forward into this tap-heavy time.

So what’s next?

Chips inserted into our palms that we swipe? The ability to pay for things purely with our eyes and mind, without the need for a card or phone?

Let’s slow things down a bit.

First of all, we need to talk about cryptocurrency. You probably know this as Bitcoin, an early noughties “fad” that was associated with the darker side of the internet.

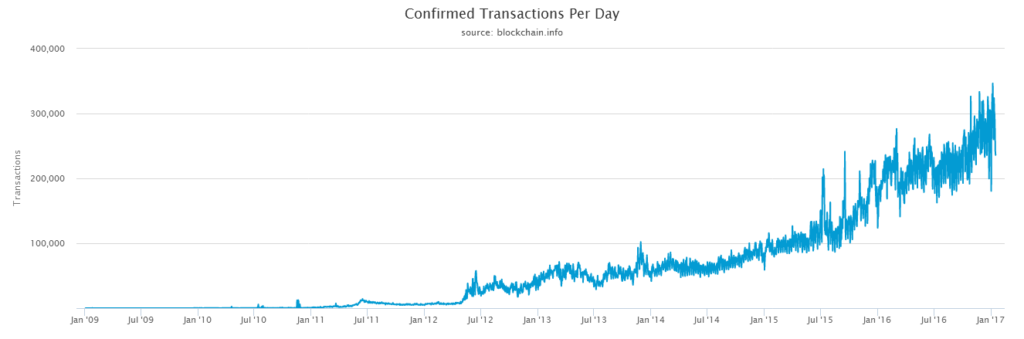

Today, cryptocurrency is wearing a new personality entirely and is becoming a huge asset in the payment world – particularly online.

But, while it seems to be on a mission to take over the interwebs, is there any chance a digital currency could ever be a part of the real world – you know, in real-life supermarkets and shops?

TenX doesn’t see why not.

This new payment solution is bridging the gap between the online and real worlds by letting people pay in brick-and-mortar stores using cryptocurrency.

How is that even possible? You might ask. Surely your average Starbucks or Walmart isn’t clued in on the whole Bitcoin revolution?

This is very true.

It’s unlikely these big guns will accept the stash of Bitcoin you’ve been siphoning away for ten years to pay for your morning coffee or a pint of milk.

Sure, there are more and more online stores cropping up each day that accept crypto, but even mega-corps like Walmart and Starbucks – that definitely have the scale to accept it in-store – don’t do it. Yet.

But TenX hopes to change this.

Users are issued with a card that can be topped up with cryptocurrency and used like normal in shops and at cash machines.

What Exactly Is TenX?

Despite pretty much bursting onto the scene in a big way in the past year, there’s still a cryptocurrency adoption problem. To address this, TenX, a virtual currencies payment solution, is taking on a “use what’s there” approach.

It’s common knowledge that card payments are the norm in most stores, and the vast majority of shops are set up to take card transactions.

This is the exact process TenX is tapping into.

Though their cards can be topped up with Bitcoin and other cryptocurrencies, they’re still using what’s already out there – the same card terminals that take USD, Euros, Yen, and every other currency in the world.

From the retailer’s side, TenX users are simply swiping a card as payment.

From the user’s side, they’re tapping into their crypto funds to pay for their real-life goods.

The card itself is managed from a downloadable mobile app, and users simply need to load up their card with crypto assets before swiping away in real life.

In the not-too-distant future, TenX plan to branch out into a touchless checkout, so users won’t even need to wield a slab of plastic to pay.

But perhaps the most interesting part is how user’s crypto is stored.

Like most cryptocurrencies, no bank is needed. Users are their own bank, so there’s no need to trust TenX to hold money as it’s not stored in their systems in the first place.

The company uses something called smart contracts to streamline and automate the processing of taking cryptocoins from the web, transferring it onto the card, and then releasing it where necessary – the conversion to “old” currencies, like dollars and Euros, happens as and when users transfer payment.

Is This the Future of Payment?

Twenty years ago the payment world looked very different, so it’s difficult to throw predictions around for the next twenty.

The information we do have is that Visa and PayPal, two of the largest payment providers in the world, are as big as they are because of the processes they have to carry out to keep running. Things like:

- Clearing and checking every single transaction that goes through on their network

- Catching cheaters and thieves, and preventing fraud in the first place

- Hiring huge customer service teams to deal with frustrated customers

Cryptocurrencies, and the payment solutions that make paying with them possible, eliminate the need for all these things. Payments aren’t centralized in a bank or in one place; rather they are spread out among its users, which eradicates any need for fraud prevention and transaction processing.

Let’s simplify.

Cryptocurrencies are stored in blockchains, which distributes transaction processing to people on the network – these are people in every corner of the world who own some sort of cryptocurrency.

This means there’s absolutely no need for backend infrastructure like you might need in a bank or at PayPal headquarters.

Without having to worry about cyberattacks on a centralized location (because, with blockchains, the “money” is spread out around the globe) and with no need to clear every transaction themselves, cryptocurrency payment solutions are saving a lot of money and simplifying systems in the process.

Okay, So What Are the Downsides?

Like with any new solution, particularly one that’s completely online-based, there are going to be some teething problems.

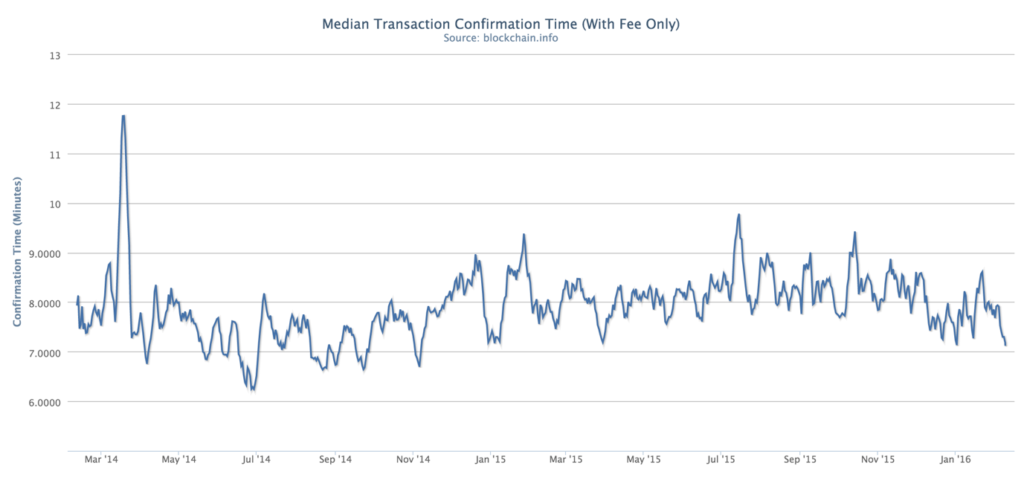

Bitcoin and other cryptocurrencies take at least ten minutes to confirm a transaction at the moment. Sometimes, it can take three to four hours when there’s a glut of orders going through.

You can imagine how this would play out in a brick-and-mortar store, right?

It’s unlikely that anyone would hang around that long to check their payment had gone through, especially when they’re just popping in to pick something up on a last-minute errand.

TenX has tiptoed around this by loading the money onto the card first, which takes away much of the processing time as it then essentially turns the card into a debit or credit card that can deliver money in seconds.

But there’s still likely to be some problems along the way.

One of the biggest hurdles that the crypto world needs to tackle before everyone sees it as a viable payment option in real-life is how people view it.

Back in the day, it was associated with criminal acts online and geeky developers who sat in the dark all day. But now that view is slowly changing as people – and vendors – start to realize it can be a great way to process cross-currency transactions.

Because that’s all it really is: another currency, like dollars, and Euros, it just so happens that this particular currency lives online.

This is how TenX is viewing the use of cryptocurrency payments in-store, and how they plan to change the way everyday people pay in everyday shops.