The COVID-19 pandemic and underlying economic instabilities have hit many Latin American countries hard. Citizens now turn to cryptocurrencies to lessen the effects of these disruptions. We delve into the details of what’s driving increased cryptocurrency adoption in Latin America, specifically in Argentina and Venezuela.

Argentina

Argentina is the third-largest country in Latin America, with a population of over 45 million people. It is no stranger to currency troubles and economic instability. In 2001, it defaulted on its national debt amid a depression, and analysts believe it is in jeopardy of doing the same now. In 2019, the country experienced a 54% inflation rate[1]. This led to an even more massive drop in real wages (the wage rate when inflation is taken into account). Inflation is an increase in a nation’s money supply that leads to higher consumer prices. It results in a “watering down” of the currency’s value or a decrease in purchasing power.

COVID-19’s effect

So, even in 2019, when international lending and employment markets were strong, Argentina faced difficult economic issues. Then the COVID-19 pandemic hit. Argentina enacted some of the strictest lockdowns in Latin America. While this undoubtedly saved lives and reduced the virus’s spread, it also further damaged an already shaky economy. The country’s central bank expects a 12% contraction in GDP along with another 38% increase for inflation This adds up to an Argentine Peso that has lost over 70% of its value in the last two years. For a county that has 10 million people living in poverty, it is a disastrous outcome.

Cryptocurrency fills the void

High inflation rates and low economic output caused Argentines to lose faith in the system. Saving is futile, with double-digit inflation rates outpacing the interest gained, and it becomes difficult to make essential everyday purchases. Historically, this situation causes citizens to flock to the United States Dollar as their means of transaction. While demand for the USD in Argentina is extremely strong right now, the country’s government recently imposed a 35% tax on transactions made with it[3]. The hefty tax, along with a $200 maximum quota per individual, make alternatives such as cryptocurrencies more attractive.

Bitcoin and stablecoins, in particular, have seen an explosion in popularity. Bitcoin is the most used cryptocurrency in the market, so its utility is a known quantity. Stablecoins are crypto-assets theoretically backed by real amounts of traditional currency, such as the USD. The most successful stablecoins on the market today are Tether ($USDT), USD Coin ($USDC)}, and Dai ($DAI). Unsurprisingly, all of these are pegged to the United States Dollar. Dai seems to be gaining the most traction in Argentina. It has become a nifty loophole to overcoming the tax and quota restrictions.

Technological and education roadblocks remain before cryptocurrencies become the preferred methods of transaction, but a recent poll of Argentines suggests the tides are turning in its favor. Over 70% of respondents feel “…that, in the current economic scenario, cryptocurrencies are the most effective way to save and protect their funds.[4]“

Venezuela

If you thought Argentina’s economy was in trouble, well, you’d be right. But, wait until you hear about Venezuela’s situation! It’s dire.

Take, for example, the inflation rate. Venezuelans would love to be in Argentina’s shoes. Over the past five years, the compounded, year-over-year inflation rate for the socialist country’s currency, the Bolivar, has been staggeringly high[5]:

- 2016: 255%

- 2017: 438%

- 2018: 65,374%

- 2019: 19,906%

- 2020 (estimated): 2,685%

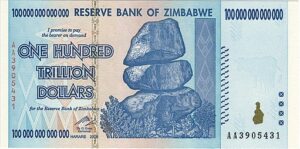

It’s so bad that the government is printing larger denominations than ever before, only for the bills to end up being nearly worthless by the time they reach circulation. For example, as of October, the newly planned 100,000 Bolivar bill was expected to be worth a mere 23 cents in USD. This situation has few modern parallels, with Zimbabwe from 2007-2009 (and now again from 2019-) being the only other 21st-century comparison.

Reserve Bank of Zimbabwe, Public domain, via Wikimedia Commons

The role of cryptocurrency

Cryptocurrency has played an interesting role in Venezuela recently. It’s been a slightly different scenario than in Argentina because the Venezuelan government issued its own cryptocurrency. Knowing the Bolivar was basically worthless and trying to skirt United States sanctions, the Venezuelan government announced the creation of the Petro, a cryptocurrency supposedly tied to the country’s oil reserves.

The coin was plagued from the start by a lack of transparency about the underlying blockchain technology. Officials initially claimed the Ethereum blockchain powered the Petro, but they altered the white paper upon release to state that NEM was the backbone. Others in the cryptocurrency community say it is a plagiarized version, or fork, of the Dash blockchain[6]. Regardless, it all appears to be a fraud, as a Reuters investigation in 2018 turned up little evidence that the cryptocurrency is used or backed up by oil reserves[7]. Its current state is unknown, and though Venezuelan President Nicolas Maduro claims citizens transact with it, it appears to have little to no actual value[8]

Use for the people

The official cryptocurrency might be a failure, but that doesn’t mean Venezuela’s citizens aren’t utilizing other digital assets. In fact, the country now ranks third on the Global Crypto Adoption Index[9], behind only Russia and Ukraine. Bitcoin appears to be the cryptocurrency of choice, as peer-2-peer exchanges have seen an enormous increase in transactions coming from Venezuela recently[10].

Summary

Argentines and Venezuelans increasingly turn to cryptocurrencies to combat the rampant inflation and economic turmoil the countries experience. They aren’t the only Latin American countries to embrace crypto, but since adoption correlates strongly with currency instability, these two countries are the most prominent examples. In a future blog, we’ll look into how different Latin American countries are reacting to this disruptive financial force. Hopefully, Argentina and Venezuela can get their national currencies in order soon and stabilize their societies. However, even after that happens, it’s probable cryptocurrency will play a significant role in citizens’ everyday monetary transactions.

AXEL

AXEL is a believer in the technology behind cryptocurrency. Our AXEL Token is the fuel that facilitates data sharing across our private, decentralized network. We employ an energy-efficient Proof-of-Stake blockchain where participants must “stake” a certain number of our tokens to validate blocks and receive rewards. It makes for a secure network that is the backbone behind products like AXEL Go. Axel Go is a private, secure file sharing and cloud storage platform that always protects your data. Sign up today for a full-featured Basic account and receive 2GB of private online storage and enough AXEL Tokens to fuel thousands of typical shares.

[1] Milagros Costabel, “Argentina’s Economy Crumbled as Buenos Aires Lockdown Continues”, ForeignPolicy.com, Aug. 27, 2020, https://foreignpolicy.com/2020/08/27/argentina-economy-crumbles-buenos-aires-lockdown-continues/

[2] Maximillian Heath, “Argentina’s GDP to fall 12% in 2020 due to COVID-19, central bank poll says”, Reuters, Sept. 15, 2020, https://www.reuters.com/article/argentina-economy-poll/argentinas-gdp-to-fall-12-in-2020-due-to-covid-19-central-bank-poll-says-idUSKBN25W0A8

[3] Jose Antonio Lanz, “Argentina’s New Dollar Tax Is a Boon for Cryptocrruency”, Decrypt.com, Sept. 17, 2020, https://decrypt.co/42215/argentinas-new-dollar-tax-boon-cryptocurrency-dai

[4] Kevin Helms, “73% of Argentines Say Cryptocurrency Best for Saving in Economic Crisis: Survey”, Bitcoin.com, Aug. 29, 2020, https://news.bitcoin.com/73-of-argentines-cryptocurrency-best-saving-economic-crisis/

[5] “inflation in Venezuela”, Focus Economics, https://www.focus-economics.com/country-indicator/venezuela/inflation

[6] Ana Berman, “Venezuela’s Petro White Paper ‘Blatantly’ Copied Dash, Ethereum Developer Says”, Coin Telegraph, Oct. 4, 2018, https://cointelegraph.com/news/venezuelas-petro-white-paper-blatantly-copied-dash-ethereum-developer-says

[7] Brian Ellsworth, “Special Report: In Venezuela, new cryptocurrency is nowhere to be found”, Reuters, Aug. 30, 2018, https://www.reuters.com/article/us-cryptocurrency-venezuela-specialrepor/special-report-in-venezuela-new-cryptocurrency-is-nowhere-to-be-found-idUSKCN1LF15U

[8] Kevin Helms. “Problems Escalate in Venezuela as Millions Rush To Spend Petros”, Bitcoin.com, Jan. 7, 2020, https://news.bitcoin.com/problems-escalate-in-venezuela-as-millions-rush-to-spend-petros/

[9] “The 2020 Global Crypto Adoption Index: Cryptocurrency is a Global Phenomenon”, Chainanalysis, Sept. 8, 2020, https://blog.chainalysis.com/reports/2020-global-cryptocurrency-adoption-index-2020

[10] Kevin Helms, “Venezuela’s Bitcoin Use Soars Amid Hyperinflation: 3rd on Global Crypto Adoption Index”, Bitcoin.com, Aug. 31, 2020, https://news.bitcoin.com/venezuela-bitcoin-use-hyperinflation-crypto-adoption/